Guest Author: Dhruv Rathod I really like the Nalanda way where Anand Sridharan sir says “Who am I backing here?” I recently visited a famous restaurant chain and there was a lot of rush. The restaurant had 8-10 waiters but all of them were stuck in taking orders continuously. When…

Leave a CommentGuest Author: Dhruv Rathod Have you ever wondered how you get such amazing food and such a comfortable lounge at an airport for just rupees 2? Such a big setup running for rupees 2 and that’s not just in Mumbai it’s in almost every airport you go seems impossible right?…

Leave a CommentGuest Author: Dhruv Rathod About the company Cummins India Limited is a leading manufacturer of engines, power generation systems, and related components in India. It is a subsidiary of Cummins Inc., a global power solutions provider headquartered in the United States. Cummins India has been operating in the country for…

Leave a CommentHolaa Multipiers!👋 In this edition of Multipie Adda, we share highlights from Multipie platform. If you aren’t on Multipie yet, do join us on the app here. Let’s get going and know what’s buzzing on Multipie lately🤩 What’s new on Multipie? A lot! 📌MULTIPIE IS UPGRADING📌 Follow new pages, new…

Leave a CommentThis week I explain how to make most of the real estate upcycle followed by what’s trending in markets and curated good reads. 1. How to make most of the real estate upcycle? 🏠 Chinese banks are struggling as homebuyers (across 25 cities) have refused to pay their mortgages back due…

Leave a CommentThis week explain why Indian Tyre industry seems to be rebounding, Pharma sector going through a makeover and key development in fertiliser industry followed by what’s trending in markets and curated good reads. 1. Is Indian Tyre industry rebounding?🚚 The market finally is optimistic about the automobile sector. But, at…

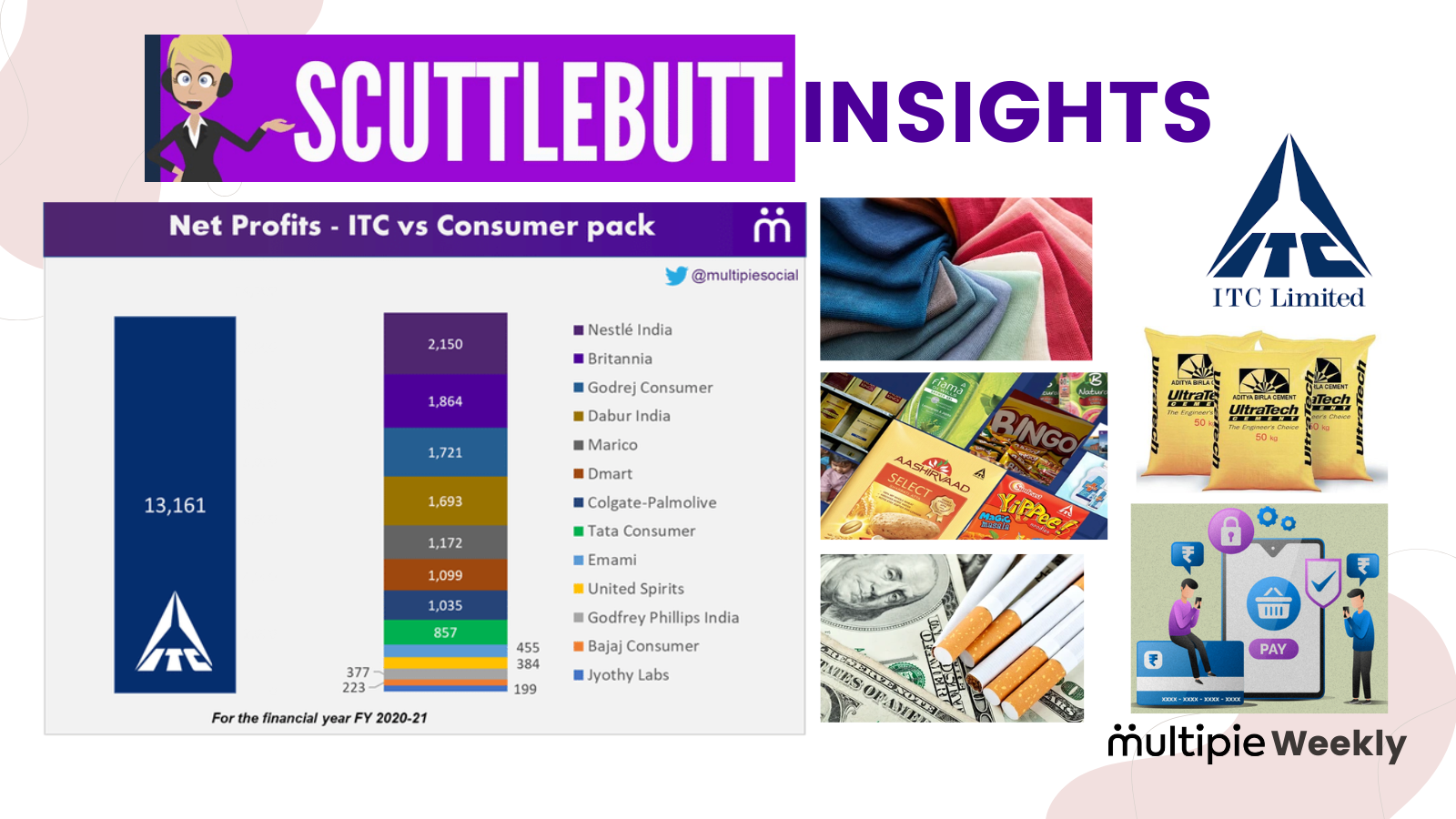

Leave a CommentThis week we cover scuttlebutt insights of six industries- Paints, FMCG, cigarettes, Cement, BFSI, and Textiles industry followed by what’s trending in markets and curated good reads. 1. Scuttlebutt insights on six key industries As quoted by Philip Fisher, getting a reality check from the people associated with the company…

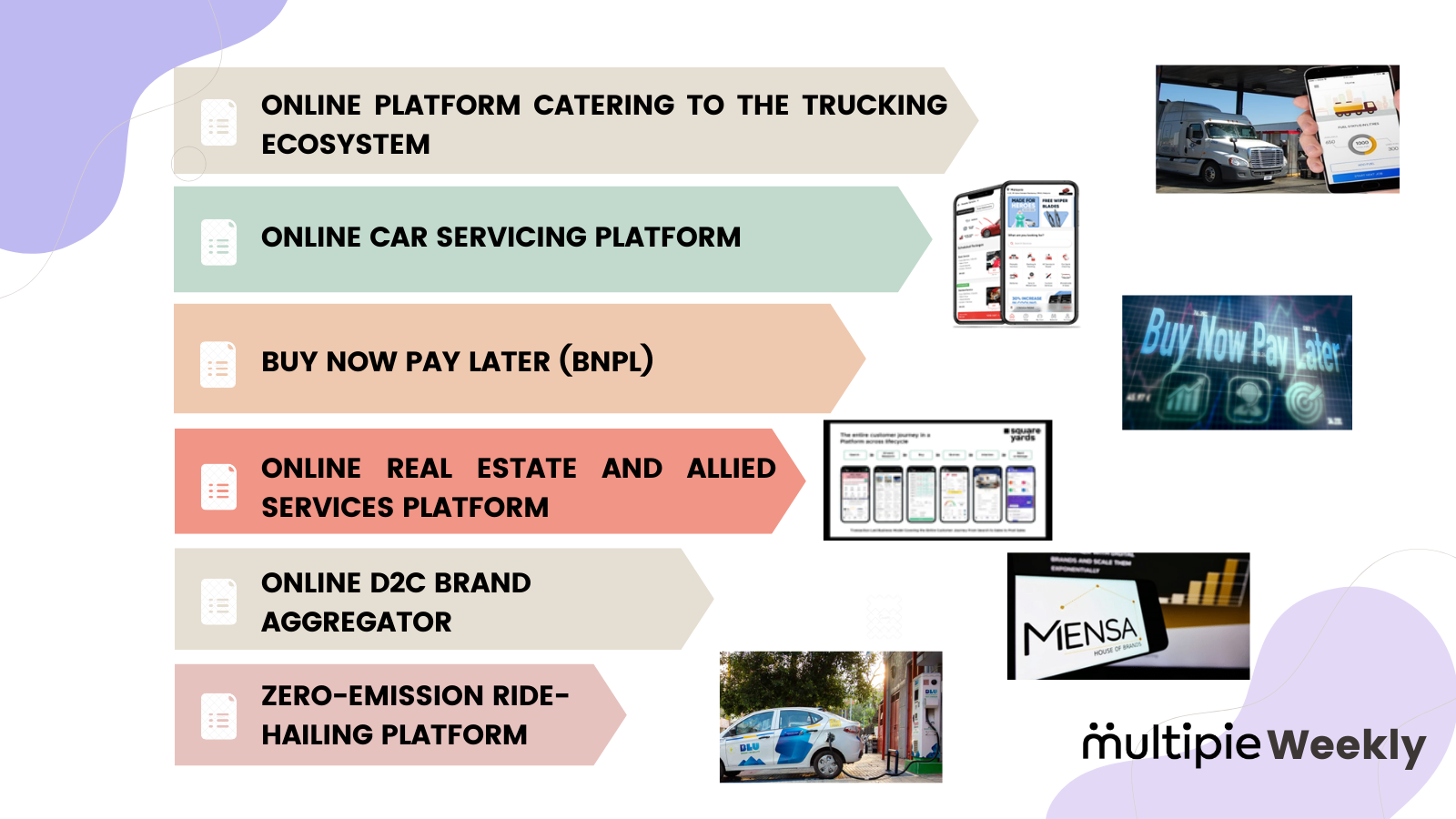

Leave a CommentThis week we focus on changes happening in Indian startup ecosystem and six interesting business models that show how India is going digital followed by what’s trending in markets and curated good reads. 1. Six business models that show how India is going digital 📲 “At least 40% of all…

Leave a CommentThis week I explain my rationale on why I think inflation worries are overinflated followed by what’s trending in markets and good reads. 1. Are the inflation worries overinflated?💢 What’s going on? Globally inflation is touching heights– India’s inflation breached 7% levels and US’s inflation came at 8.6% in May,…

Leave a Comment