This week we cover Indian home loan market to double in 5 years, Why Punjab reduced alcohol prices, Difficulties in switching to EV’s/renewable energy easily and EPFO investment to increase to 25%; followed by what’s trending in markets and curated good reads . 1. Indian home loan market to double…

Leave a CommentThis week we explain how one can reduce their taxes by utilizing the deductions properly followed by what’s trending in markets and curated good reads . 1. How to reduce your taxes?🧐 Written by: Pankti Shah It’s better late than never to understand your personal finance because it’s your money…

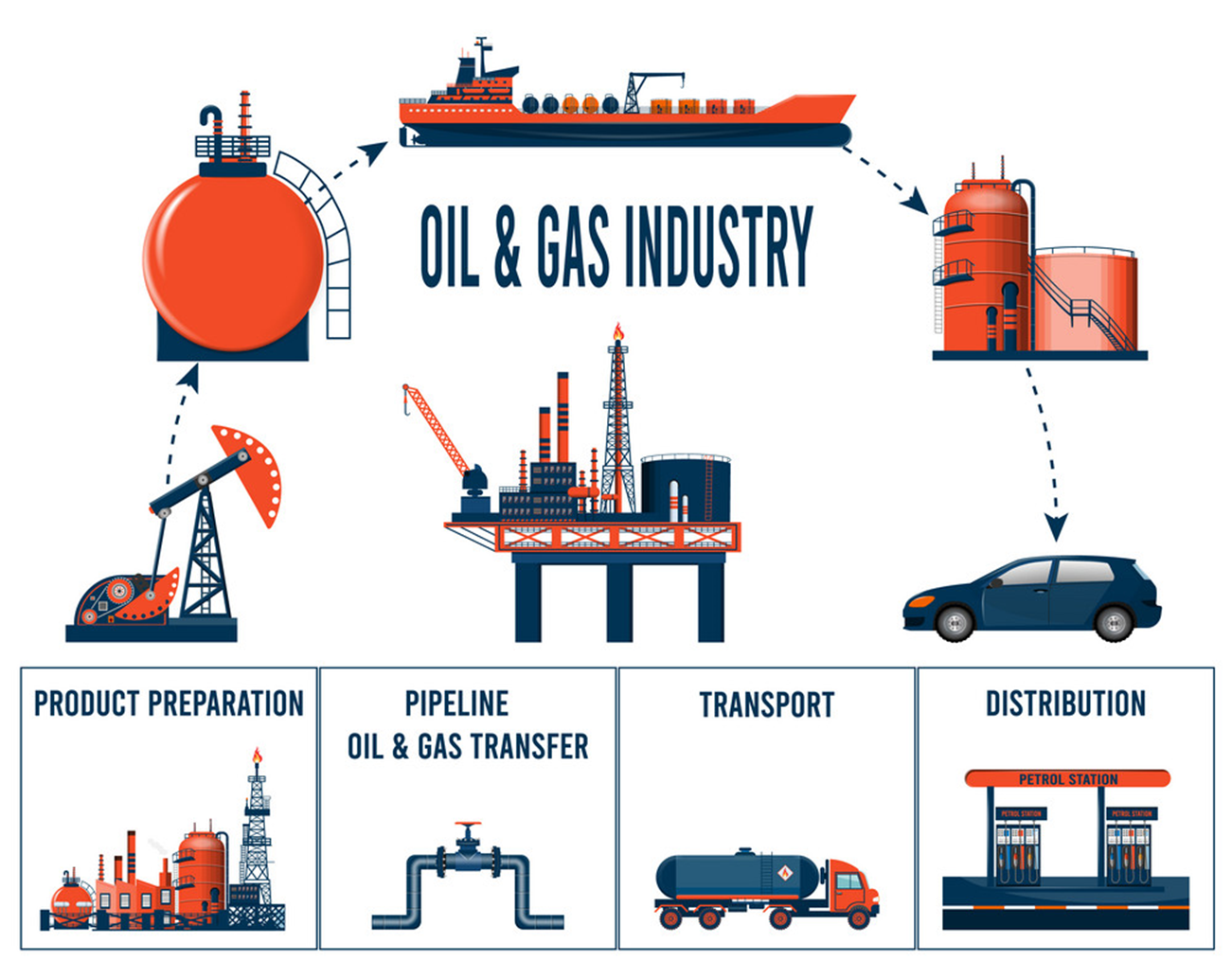

Leave a CommentGuest Author: Jay Prakash, Co-founder: Dhan Suddenly from being very export-oriented, countries have started imposing measures to protect their own supplies. Moving from.. Glocal to Local..!🌎 Before we move forward, did you know Dhan is also on Multipie!🤩 You can follow them by clicking here. Let’s understand, why restrictions are…

Leave a CommentThis week I explain how investors should think of businesses that diversify into new segments and why all diversifications are not bad, followed by what’s trending in markets and curated good reads. 1. Market snapshot📈 The wheels of fortune in the stock markets are turning again. I mean sector rotation.…

Leave a CommentThis week we analyze Q4FY22 results and discuss which sectors are standing tall against all the odds followed by curated good reads for investors. 1. Sectors that are standing tall against the odds🔝 “In the midst of chaos, there’s also an opportunity” Amidst the turmoil & mean reversion happening, one…

Leave a CommentThis week I explain how the mean reversion is happening in the overall spectrum and we can see things coming back to getting sanity, how they were supposed to be; followed by what’s trending in markets and curated good reads. 1. Market snapshot📈 Markets remained slippery last week majorly due…

Leave a CommentThis week we explained why we can see signs of turnaround in automobile sector followed by what’s trending in markets and curated good reads. 1. Market snapshot📈 In the last week, no particular sector showed strength, with COnsumer and Power being the two in green. NIFTY IT index continues to…

Leave a CommentThis week we covered market snapshot, explained how Free Trade Agreements open massive opportunities followed by what’s trending in markets and curated good reads. 1. Market snapshot📈 The market was volatile last week and it closed at a loss of 0.9% which could have been caused due to continuous net…

Leave a Comment1. Market snapshot📈 Last week, the HDFC Ltd & HDFC Bank’s merger stole the show, with indices dancing to the tunes of the twins. The big announcement came pre-market open on Monday, sending both stocks into dizzying heights of up 17% during the day, closing slightly lower with 10% gains.…

Leave a Comment