Hello, this week we explained why Coal prices are sky rocketing and why Coal India was the top NIFTY gainer in September, share our three favorite charts of the week, along with some curated reads. Happy reading! Please share and subscribe if you find these helpful 🙂 1. Market snapshot …

Leave a CommentIn a recent interview with Udayan Mukherjee, the big bull Rakesh Jhunjhunwala made an interesting bold statement – “I think nobody has read the Electricity (Amendment) Bill. Once it passes, it will be bigger than 1991 reforms.” In this post, we simplify and explaining the ongoing Power reforms In summary,…

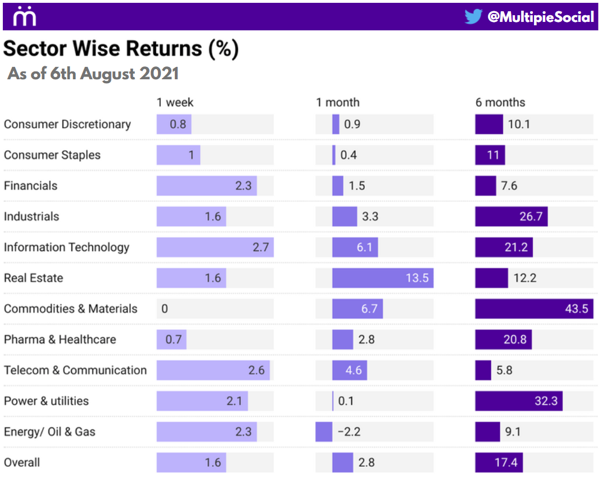

Leave a CommentHello, over the last few weeks, we are seeing increasing policy developments which augurs well for long term investors. We have covered those along with some curated reads. Happy reading! 1. Market snapshot – Telecom rallies on AGR relief The week that was: Telecom was the key gainer last week with…

Leave a CommentThis week, we explain why the Indian bond markets may be at an inflection point, summarize highlights of some great reads of the week, share insights from Uday Kotak and more. If you like it, please consider sharing and if you haven’t subscribed, you can do here to get this weekly…

Leave a CommentWelcome to the 17th edition (13th on blog) of our weekly newsletter. Topics for this week include our market snapshot, thoughts on the National Asset Monetisation Pipeline, highlights from Edelweiss’ Small and Midcap model portfolio, some dope career advise, good reads and more. If you are finding these helpful, please…

1 CommentSmall caps and mid caps are the darlings of the market again and outperforming the index stocks. Let’s examine the performance of small cap index over the last 5 years: NIFTY small cap saw a one-way rally from 4,900 levels in April 2016 to 9,580 by Dec 2017. This was followed…

Leave a CommentHello, we are back with 15th edition (11th on blog) of our weekly newsletter. But before that, note that our annual report tracker is now updated with over 800 annual reports and we will be sharing some insights on Q1 results on our Twitter page today. In this weekly, we…

Leave a Comment