This week we focus on changes happening in Indian startup ecosystem and six interesting business models that show how India is going digital followed by what’s trending in markets and curated good reads.

Outline

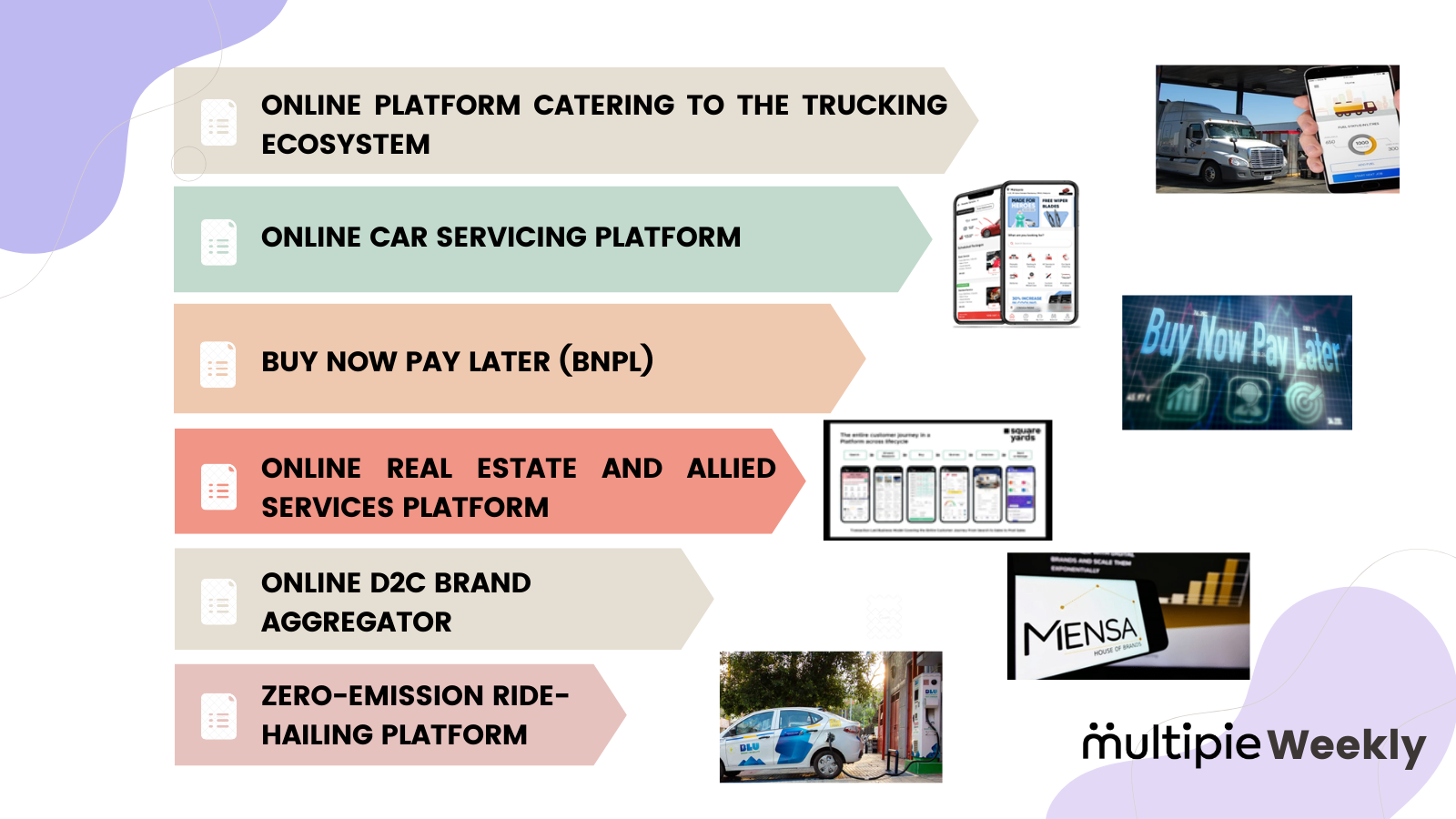

1. Six business models that show how India is going digital 📲

“At least 40% of all businesses will die in the next 10 years if they don’t figure out how to change their entire company to accommodate new technologies”

~John Chambers (Cisco)

I couldn’t agree more with the above-quoted statement. However, there were a few businesses that I never thought could be operated digitally but now I see some founders making it happen.💫

So, here’s the list of such business models which I found really fascinating from the digital conference report by Axis:

- ONLINE PLATFORM CATERING TO THE TRUCKING ECOSYSTEM🚚

The trucking industry is very fragmented in India and most truck owners are based out in small towns. There are many issues in this industry such as the presence of middlemen (brokers), delays by drivers, majority of transactions in cash and informal credit channels.

The company leading the change:

A company Blackbuck is catering to the above-stated woes. It is India’s largest trucking platform providing integrated services such as:

- Payments: Managing end to end Fast tag payments via tie-ups with banks

- Telematics: Device sold to owners with GPS services

- Freight marketplace: Matching demand & supply of loads, and

- Financing: Offering vehicle & working capital loans at better rates

This is crucial because, through this platform, Blackbuck is catering to overall the target addressable market (TAM) of USD 35 Bn🤩 and this will make the trucking ecosystem more organized & efficient.

- ONLINE CAR SERVICING PLATFORM🚙

For 70% of the cars in India, customers do not opt for after-sales service post the expiry of warranty after 3-5 years. This is because people prefer local service providers, but the key challenge here is the inconsistent supply of spare parts and a lack of a transparent pricing mechanism.

The company leading the change:

A company GoMechanic is building its supply network & stockist points currently. Customers can book vehicle service/ repair through the app, after which the nearest shop is allocated to the customer by the company.

A noteworthy thing here is that the prices on the app are standardized, all the necessary spare parts are always available and as the company deals directly with the part manufacturers – so it gives the guarantee that genuine parts are only being used.

If the company is able to scale up well, it can definitely bring a change in habits by bringing more convenience & trust in the sales service market of USD 14bn🙌

- “BUY NOW PAY LATER” (BNPL) 💸🔄

Banks & NBFCs usually focus on affluent and mass premium customers, so to cater to the “aspirer” (new to credit) category, BNPL was established. The rationale behind coming up with this credit product was to help customers to build their credit history & in turn create financing options.

The company leading the change:

A company “Zest Money” provides BNPL facilities via omnichannel presence. It has its own pre-determined credit risk limits and the company has also partnered with many D2C players in segments like e-commerce, air ticketing, fashion, health-tech, etc. It has the largest network of merchants and customers in the category.

Zest generates revenue from both ends – customers as well as merchants in the form of the processing fees, fees from merchants, share in interest income, collections & other fees.

- ONLINE REAL ESTATE AND ALLIED SERVICES PLATFORM🏠

Everyone knows that real estate is still an unorganized industry with many grey areas. One of them is that majority of deals happen via brokers, that too without proper registration.

The company leading the change:

A company Square Yards started 8 years back with the goal to offer an entire gamut of real estate services. It has the highest market share (8%) in the property tech industry and we can expect the industry to grow at 34% CAGR till FY21-FY26E.

Square yards is also planning to expand in other services like home renovation & property management. It is the only company that has been able to scale up in the B2C real estate business and has the largest amount of B2C updated data across key markets.

5. ONLINE D2C BRAND AGGREGATOR👗

India is brand starved when it comes to swadeshi brands. There are many promising digital brands out there, but these are not able to scale due to lack of distribution infrastructure.

The company leading the change:

The company Mensa brands acquires promising digital-first brands in the lifestyle categories & scales them exponentially, by using its technology & execution capabilities. Mensa is majorly focused on the lifestyle category and it is EBITDA positive. Not just this, Mensa became a unicorn in just 6 months of starting its operations🤩

Its goal is to grow all the brands in the portfolio by 4-5x and to achieve 15-18% EBITDA. Currently, they don’t have their own brand yet. Management’s goal is to have 100 brands under their portfolio & serve 50mn+ customers by FY26.

Note: This model is based on a global Thrasio model and you can read in detail here.

6. ONLINE ZERO-EMISSION RIDE-HAILING PLATFORM🚖

Everyone is realising the importance of preserving our environment now and cars are no different. However, in the ride hailing industry (Ola/ Uber), the cars used are fuel-based. Not just this, many customers also face ride denials & surge in prices while booking the cabs.

The company leading the change:

A company BluSmart is the first and largest smart electric on-demand mobility platform in Delhi NCR & has to date delivered 1.6mn trips covering 15mn Kms. The company has an asset-light model (cars are not owned by drivers- cars are taken on lease) and has low operational costs compared to Ola and Uber.

Vehicle charging stations are owned by company partners, partnered with real estate companies to build BluSmart hubs. Also, for the EV cars, the company recently entered into an agreement with Tata Motors (For supply + financing).

The company seems to have disrupted Ola/ Uber in Delhi and it is interesting to see if they grow pan India.

Bottom line:

We explained in one of the previous write-ups as well how we need innovations & technologies to change the world. This is why we must not mock start-ups. Not saying, all of these businesses will be able to scale well profitably, but what matters is driving new changes.Because as they say - the only constant is change

2. What else is trendin’?🤙🏻

✔️ NIFTY-500: Corporate profit to GDP ratio (4.3%) at a decade high📈NIFTY-500 profits hovered between INR 4-6 Trillion range but in FY22 it surged to INR 10 Trillion. The increase in profits is driven by BFSI, Oil & Gas and Metals sectors.

✔️ Commodity prices have fallen from their 2022 peak. This will definitely give some relief to sectors for which commodities act as raw materials such as automobile and construction. To know, why inflation worries are over-inflated and what are the reasons to be optimistic about India, you can read our last weekly newsletter.

3. Good reads 📚

3.1 “In search of value”- The prequel by Kumar Saurabh.

3.2 The first investment primer by investment master class.

3.3 The hardest investing questions to answer by Ben Carlson

See you next week. Until then, happy investing!