In recent weeklies, we have covered various macro and industry highlights such as Inflation, the Commodity boom, Real Estate recovery, Textiles measures, Ethanol blending, etc. In this weekly, the focus is more micro, where I share some thoughts and snippets on individual companies. Also experimenting with a category called Visual Weekly. At the end, have shared few good reads and recommended videos.

You can check previous weekly here. Please subscribe if you haven’t and help reach more people by sharing this – we write every week for you and this is our 14th note! Let’s start.

Outline

1. Market snapshot

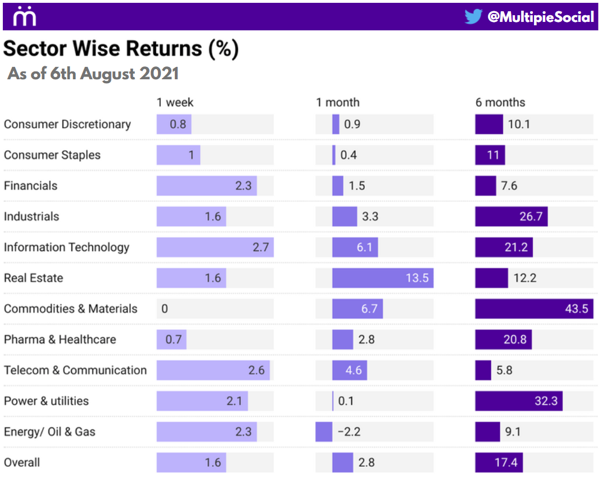

Indian markets have been on a tear last week, with Nifty breaching 16,000 levels despite some global weakness. While all sectors closed in green for the week, Real estate has been the best performer for the last month with ~14% returns (we had written on Real Estate a month back here).

Large caps reversed the scale and have outperformed small and microcaps over the last week.

Here is a sector-wise performance snapshot by MSCI to understand the direction of flows:

Observations:

- Commodities and materials has been the top performing sector throughout the last year with 1 year returns of 110% and YTD returns of 52%

- Industrials has been the second best performing at 85% and 52% resp.

- IT sector is seeing some moderation after an year of outperformance on fears of margin moderation going forward

- Telecom is seeing strength recently after long underperformance

- Financials, the highest weight sector (26%), has been inline the index

- Power and Utilities have been the least performing sector throughout

2. Some interesting read through on companies

2.1 Tech Mahindra

Tech Mahindra is a key beneficiary of increasing 5G spend. While new large deals have picked up in the last 2 quarters after a slow CY20, TechM trades at a discount of 30-35% on 1 year forward P/E when compared with the IT trio of TCS, Infosys and Wipro.

Amongst the Tier-I IT services pack, Morgan Stanley expects FY22 EBIT margin expansion only for Tech M (~95 bps). Expects flattish for TCS and decline across Infosys, HCL and Wipro.

2.2 HDFC and ICICI Bank: Wholesale lending is safer than retail; Depositors getting squeezed

Retail loans are generally seen as safer than wholesale, leading to a marked industry shift towards retail originations in the last few years. However, segment-wise NPA trends for HDFC Bank show the opposite – post-Covid, Retail NPAs are trending higher while wholesale NPAs are declining!

Over the last 8 years, cost of deposits for leading private banks has declined by 2-3% and is at historical lows of ~4%. This means the depositors get only 4% interest on deposits, which doesn’t even cover for inflation which stands at 6.5%! We had written a note explaining how you can protect your savings from inflation without taking undue risk. You can read that here

2.3 Castrol India sustained Gross Margins despite Crude Oil prices doubling in the last year

Results of Castrol India indicate that road traffic in India is back to normalcy. In Q1, Castrol India saw 81% y-o-y revenue growth on a low base to Rs 890 crores. Volumes have recovered strongly in July 2021 as economic activity resumed and stands higher than pre-Covid levels. Despite base crude oil prices doubling in the last 1 year, Castrol could sustain its gross margins as it took three price hikes in H1CY21.

Interesting: Castrol has launched a new concept of Castrol Express Oil change outlets which offer quick oil change service for consumer’s on-the-go. Castrol aims to increase Jio-BP outlets to 5000 in the coming 5 years.

4. China’s Tech Crackdown – Flow of VC capital into Indian start-up ecosystem

We published our analysis on China’s tech crackdown where we looked at the developments from multiple perspectives such as:

— Antitrust issues with Digital ecosystem

— Rise of socialism

— Five Year Plan: What you should know

— Aging population base

Interestingly, one immediate effect has been the flight of VC capital from China to India (also India outperformed other Emerging markets in July). Infact, July 2021 saw the highest ever funding for Indian start-up ecosystem at ~$9.5 BN (~INR 70,000 cr) vs $4.8 BN for China, making it the first such instance since 2013. Here is how monthly VC funding in India looks like:

It is encouraging to see that the funding is spread across multiple categories indicating bullishness on the India growth story.

5. Visual weekly – Some interesting charts

5.1 Tech giants in US crush profit records in Q2 CY21 (Q1 FY21)

Quarterly profits for FAAMG companies (Facebook, Apple, Amazon, Google, Microsoft) increased by $35 BN in Q1 2021 over Q2 2020. That’s 2x higher than the annual profits of the Indian Tech sector!

5.2 Power demand in India to rise 5% in FY 2022 (highest in 4 years)

5.3 Key auto-components for high-speed electric two-wheelers

Last week, Investec released an informative note on the Electrification of Auto and auto ancillaries. We highlight this chart on cost of key components for a high-speed electric two-wheeler, the category that is seeing rapid adoption.

They expect large new profit pool creation across categories such as Batteries and Battery Management System (BMS), Traction motors, Controller, Telematics and DC-DC converter.

5.4 Financials & Energy has lost ground to Tech and Healthcare verticals

6. Good reads and other news:

Vodafone – will it survive, will it not?

- Last week, Kumar Mangalam Birla resigned for the board of Vodafone-Idea

- Soon after the Government reversed the retrospective tax bill that had impacted Vodafone Plc!

- We strongly recommend you to read this brilliant article by Prosenjit Dutta to understand the current situation of Vodafone, the back story as well as possible solutions!

Amazon scores big win in the battle against Reliance-Future deal

- The SC announced verdict in favor of Amazon in its bitter fight to stall the Rs 24,731 cr merger of Future Retail with Reliance Retail.

- Amazon had acquired a stake in Future Retail’s entity Future Coupons in August 2019 and claimed that the terms of this deal prevents Future Group from selling Future Retail to Reliance

- However, the judgment is related only to the enforceability of the arbitrator’s order and not the merits of the disputes. The final decision of the arbitrator is still pending. Read here for more.

Government launches E-Rupi

- Cashless and contactless instrument used to make digital payments

- This is NOT India’s Central bank Digital Currency (guidelines awaited)

- It just eases the process of transferring already existing money by using QR code or SMS string based e-voucher for digital payments. Read here for more.

Recommended videos of the week:

- What Elon Musk’s 42,000 Satellites Could Do To Earth (link)

- Amara Raja Batteries management speaks about new investments and new technologies (link)

Non-finance topic: Turn your doodles into art!

- Google’s latest AI experiment is a web-based drawing tool called AutoDraw that converts your scribbles and doodles into beautiful, symmetrical icons/ cliparts that you can download for free!

- Take a break and give it a try here – it’s fun!

That’s all for this week. If you liked this, you can subscribe here. Happy weekend!