Hello👋 This week, we covered the Market snapshot, Dynamics of the Paper industry- explained why the share price of paper companies is increasing and our view on which companies one can invest in to play out the industry’s trajectory followed by what else is trending in markets & curated reads.

Outline

1. Market snapshot

Optimism is back! Last week, the overall market was up by 3.3%. All the sectors closed in green last week and Financials & Commodities were the top gainers (up by 5.3% and 4.4%).

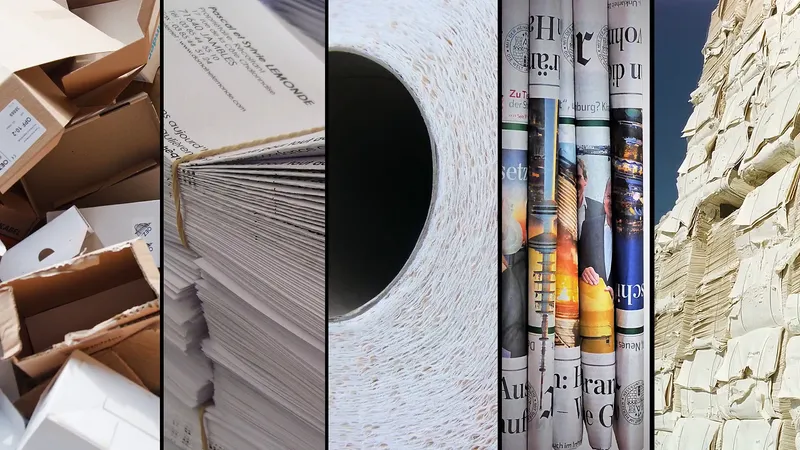

2. Paper gains are real & not just “on paper” this time 📰💰

“Commodities are ruling the markets, economy, earnings- everything!” due to global demand-supply issues and this has been like an opportunity in disguise for many Indian companies with potential capabilities.

Like any other commodity, the paper industry is also facing a global demand-supply issue & not due to very obvious reasons!😵 Also, since last month or so, the share price of many paper companies has been surging notably and of course, we will discuss the rationale behind the same in detail. But,

First things first! ☝️

Before jumping to details, its crucial to understand the paper industry’s basics in brief.

- The Paper industry is fragmented in India but only a few pure-play significant players exist.

- Paper can be manufactured either by Waste recycle paper or Pulp. Out of total paper capacity in India, ~65% of paper is manufactured using waste recycled paper i.e. B/C grade mills are more in number compared to A-grade mills (manufacturing from pulp).

- Different grades have different applications like waste recycled paper is used as newspaper, packaged board, etc. whereas paper made from pulp is used as coated paper.

Of course, all the different paper categories have different growth potentials & margins. For e.g.: Printing paper is growing at lower single digits whereas Packaging board is growing at a very attractive double-digit rate due to high-value industries being catered like pharma, FMCG, etc.

- Realizations in the domestic market are attractive compared to international markets due to established brands in India and a lot of competition in international markets from their local players.

Why global demand-supply mismatch in the paper?

- China was the largest importer of waste paper in the world & it used to recycle the waste paper to produce & sell the finished product but the Chinese government banned waste paper imports in early 2021 because of environmental issues.

So for the manufacturing of paper, China started using pulp instead when its supply was already impacted due to lockdowns during covid, so high demand and lower supply led the pulp prices to increase initially. For reference- In just one-quarter of Q3FY21, pulp prices increased from ~$475/ton to ~700/ton (also led by high freight costs)

The story doesn’t end here…

- Europe was one of the largest exporters to many countries including India. But waste paper collections were reduced significantly as it needs the labor to collect the same and during lockdowns, collections didn’t happen so even the supply of waste paper started reducing.

So, Europe banned waste paper exports to countries like India. As a result, of it, waste paper prices also went above the roof.

The situation now: Pulp prices have started coming down but waste paper prices are still at upper levels. But as A-grade category i.e. paper produced by pulp always has a premium pricing, manufacturers are keeping the A-grade category at higher prices too to ensure it still gets the premium even when the raw material (pulp) prices have declined.

Source- Centrum Broking

This is leading to:

Once in a lifetime opportunity for Indian players…

This mismatch in the global industry is turning out to be an opportunity for Indian players because the majority of the Indian paper producers are backward integrated so the costs are already under control.

On the other hand, due to the higher domestic & international prices, paper companies are having their peak productions, realizations, and margins. Not just this, in fact, many players have also started expanding new capacities too, from which they will definitely benefit for the next ~1.5-2 years.

Which Indian players are best poised to benefit?

If we look at capacity expansion & margin comparison: JK Paper, West Coast Paper Mills Ltd, and Century textiles & Industries Ltd seem the best companies amongst the basket to invest and take advantage of the current trajectory in the industry.

3. What else is trendin’?🤙🏻

✔️RBI announced developments for the microfinance sector (MFI’s) which might benefit the players. The guidelines include:

- Now the MFIs can consider “household income” as their criterion to give loans. Also, the limit to give a loan by an MFI was the household income of 1.3-2lakhs p.a. But now this limit has been expanded to 3 lakhs. So this will lead the target addressable market (TAM) to increase.

- Removal of limits on ticket size, tenures, number of lenders per borrower will definitely increase the flexibility to much extent.

- Also, the spread cap for NBFC-MFIs has been removed, this will especially help small players with a higher cost of borrowing to keep sufficient margins for themselves.

- Regulated Income-EMI ratio i.e. if the monthly EMI exceeds 50% of monthly household income, the limit needs to be met & no new loans can be provided till the time limit is met.

✔️India might buy crude oil at a much cheaper rate directly from Putin! 😎Russia is in talks to sell its oil & other commodities at a heavy discount.

India will be willing to buy directly from Russia because it imports ~80% of its total crude oil needs and is currently spending its foreign exchange reserves to buy the same at extraordinarily high prices.

✔️Blinkit to merge with Zomato in the next 60 days. This will help Zomato to compete with Swiggy in the quick commerce space. Interestingly, last year Blinkit raised $120Mn from Zomato at a $1Bn valuation, so this merger deal seems comparatively at a lower valuation.

4. Good reads 📚

4.1 Many bull market stories run around real estate, land banks, reforms, etc. Analyzing a Real estate company through financial statements is misleading.

Check out this thread to understand the possible issues which one can never figure out from just reading reports of listed real estate companies.

4.2 An article on K.V Kamath explaining “Indian banking industry in its best shape now since last 50 years”.

4.3 A massive loss-making company Ruchi-Soya has reported ~880crs profits in the last 12 months. To know more in detail click here.

See you next week. Until then, happy investing!

Join us on Multipie if you haven’t yet by downloading the app by clicking here – for ios, android & web.