Unless you are living under a rock, chances are you have heard about China’s regulatory crackdown on its tech sector. In our last weekly, we covered China’s tech regulations in brief. In this post, we go down the rabbit hole and look at it from nine vantage points:

Outline

1. Market Moves – China underperforming Emerging markets

First of all, as a precursor, FIIs have been pouring money in China and global holdings of Chinese stocks have gone up by 40% to more than $800 BN just over last year.

And China has 40% weightage in FTSE emerging markets ETF. China stocks reached peak just before Chinese New Year break in February 2021. Since then prominent China tech stocks are down, some up to 93% (yes you read it right) for the year. The broader index like Shanghai Composite is down 2%, but Education and Tech related stocks are down ~ 90%. They have underperformed global markets and are majorly responsible for underperformance of broader Emerging Markets (EEM).

One of the reasons has been that other countries have intervened deeply through both fiscal and monetary expansion, but China has done neither. China Policy Rate is 2.2% vs zero or negative in developed markets. On the other policy front, China being opaque, no one surely knows what is happening. But some themes are emerging which look credible.

2. Jack Ma and the Ant Financial IPO that never happened

The whole intervention situation started with the cancellation of Ant Financial IPO in November last year. Jack Ma, then CEO of Alibaba (who owns Ant Financial) chided Chinese regulators for stifling innovation, and said that Chinese banks suffered from a “pawnshop mentality” given that banks still relied on a system of “pledges and collateral”. This angered the authorities and led to cancellation of the IPO even after they had collected the money (which had to be refunded later).

Jack Ma was not the only one. They also went after Didi Chuxing (largest cab hailing service in China) and asked them to remove their app from the app store right after their IPO in the USA on 30th June 21. On Didi’s part, they rushed through the IPO (that too right before the Politburo meeting of China’s CCP) despite Chinese authorities encouraging Didi to delay its listing and examine its own data-security measures.

China also pursued antitrust against Tencent, Baidu. Even the CEO of Bytedance (owners of Tik Tok) resigned in May saying that he lacks some of the skills that make an ideal manager. The real story may not be known, but what he says is tough to believe.

So why is China doing what it is doing? Is China looking to destroy the whole tech sector? If yes, why? And if not, then what is the story?

JP Morgan’s Chief China Economist, Haibin Zhu provides his views on some of the drivers behind the recent regulatory changes in the internet / fintech / education/ healthcare and capital market developments in a recent note. He mentions that:

China’s long-term agenda is to develop into a modernized socialist economy and achieve the nation’s rejuvenation by the middle of this century. Meanwhile, as China is moving into a new development stage and facing different external environments (e.g. changing US-China relationship), there will be several new features going forward. These include a) “Common prosperity”, which implies that focus on housing, education and healthcare, which are perceived as three major burdens for the Chinese middle-income families, will receive high priority; b) Green development and de-carbonization as an opportunity to develop new energy, new technology and new sectors; and c) Innovations and independence in key and foundational technologies to shield against the risk of technology decoupling between China and the US but also to achieve productivity improvement and sustainable growth.

Let’s look at this in more detail based on writings by two China experts – one is Dan Wang and the second is Lillian Li.

3. Rise of Authoritarianism and Socialism

Dan Wang works for GaveKal Dragonomics. He writes a letter every year and in his 2020 letter he wrote (some parts are being reproduced here, emphasis and in brackets are mine):

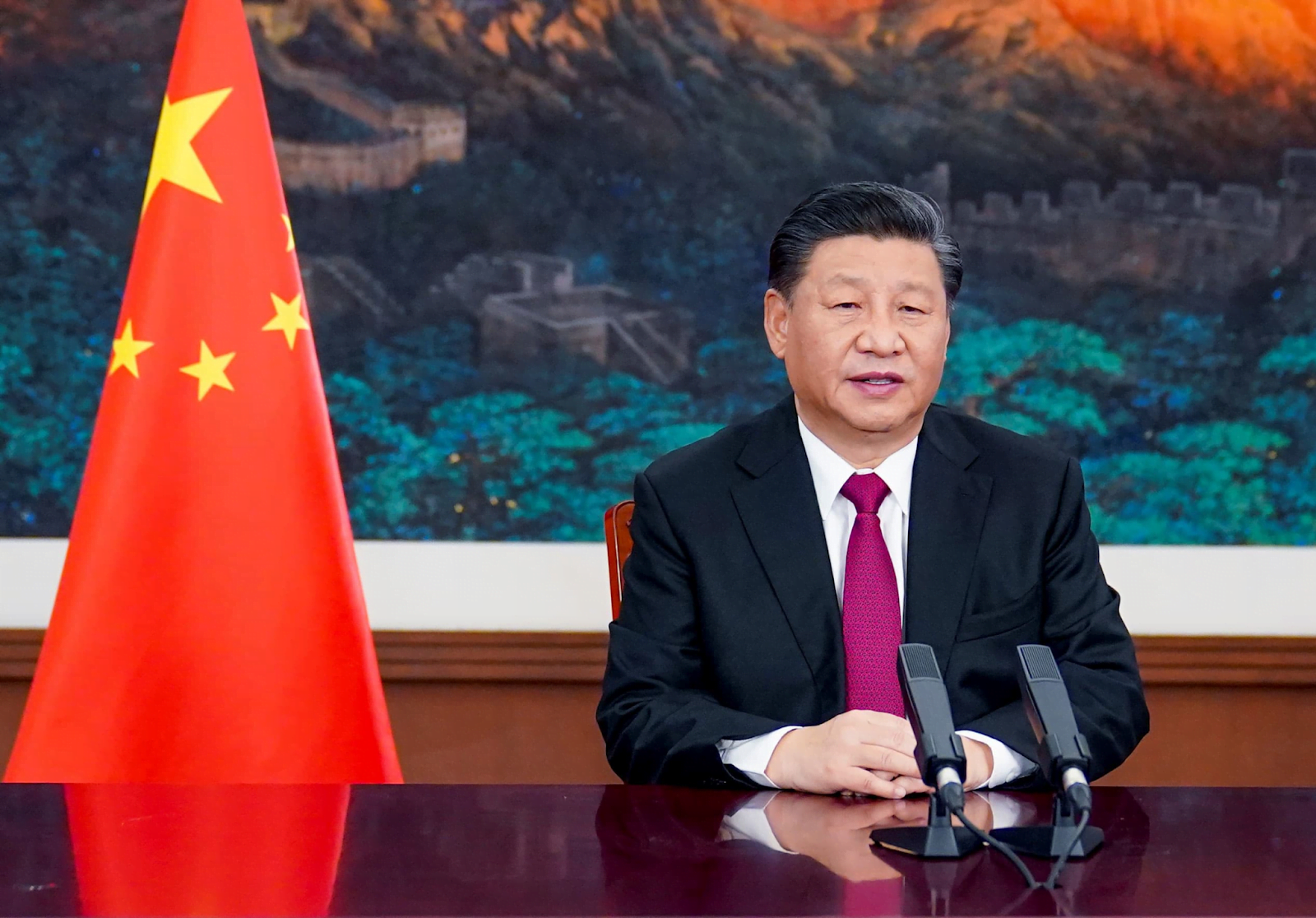

In July (2020), Xi reminded us that “socialism with Chinese characteristics has many distinctive features, but its most essential is upholding leadership by the Chinese Communist Party.” In other words, socialism with Chinese characteristics means the party is never wrong.

It helps, of course, that Xi is a genuine believer in socialism, which to him is both an instrument as well as an end. He’s leveraging that belief to reject decadence and assert agency to point out new lines of advance.

“With its emphasis on the real economy, it (China) is trying to avoid the fate of Hong Kong, where local elites have reorganized the productive forces completely around sustaining high property prices and managing mainland liquidity flows. With its emphasis on economic growth, it cannot be like Taiwan, whose single bright corporate beacon is surrounded by a mass of firms undergoing genteel decline. With its emphasis on manufacturing, it cannot be like the UK, which is so successful in the sounding-clever industries—television, journalism, finance, and universities—while seeing a falling share of R&D intensity and a global loss of standing among its largest firms.”

It’s become apparent in the last few months that the Chinese leadership has moved towards the view that hard tech is more valuable than products that take us more deeply into the digital world. Xi declared this year that while digitization is important, “we must recognize the fundamental importance of the real economy… and never deindustrialize.” This expression preceded the passage of securities and antitrust regulations, thus also pummeling finance, which along with tech make up the most glamorous sectors today.

While promoting the status of science and technology with one hand, the Chinese government has with its other hand reined in the activities of consumer internet companies. The “tech” giants are highly-capable companies that print cash. But they’re barely engaged in the creation of intellectual property, excelling instead on business-model innovation and the exploitation of network effects.

Some of the themes that are clearly coming out from Dan Wang’s 2020 letter are:

- Increasing emphasis on socialism

- Chinese Communist Party will remain supreme

- China is clearly focussed on the real economy and innovation within that

- Movement towards hard tech instead of fashionable consumer tech

4. Increasing Regulations to Redraw Boundaries For Private Companies

Let’s come to Lillian Li. She writes about the Chinese tech ecosystem through her newsletter called Chinese Characteristics, where she highlights increasing regulations for private companies. She writes:

Tech platforms pose significant challenges to nation states’ legitimacy. They are becoming de facto institutions, not just providing crucial utilities that are central to the lives of citizens but setting the rules of the game in which society operates. Facebook sets the content moderation policy for one-third of the world. Twitter and others de-platformed the former president of the US, reducing him to a digital persona non grata. These are powerful private entities that are part monopoly and part public goods, but consumer welfare is not a core part of their agenda. The tech-lash is global.

China lags in rudimentary law making and implementation. There’s catching up to do for Chinese law and regulators to reach parity with established Western practices. Partly due to imperfect information and partly due to the lack of consensus on the regulatory approaches to take, Chinese regulators have historically taken an-observe-then-act approach.

5. China’s 14th Five Year Plan

So I think the actual question here isn’t why tech companies are facing regulation, as Chinese tech history has shown that will always happen. The question should be: Why now? It can be split into a few reasons:

- Chinese Tech platforms have shifted towards value extraction rather than innovation for growth

- China needs rebalancing towards a more innovative ecosystem – Technology targets in the 14th Five-Year Plan are ambitious. AI, Quantum Computing, Semiconductors and Genetic research — future technological growth drivers won’t be e-commerce but deep tech.

- The intent with regulation is not to kill innovation but to redraw the boundaries within which private companies can operate to maximize their profits

A special reference has been made to the Five Year Plan (FYP). Why is the FYP so important for China? Or rather, for the world to understand what the focus of the CCP will be in the coming years.

China is still a very centrally driven economy. The blueprint of the same can be found in what is called the Five year Plan. The 14th FYP was for 2021-2025. Lillian Li has beautifully covered this in her newsletter, some of the key points highlighted being:

Unlike prior years, there wasn’t a concrete GDP target. Conversely, other indicators that traditionally did not have numerical targets attached to them now do, indicating higher focus on these areas. These include population growth, healthcare support and growth of high tech sectors.

35% of indicators are about social welfare, indicating a rebalancing toward social factors – It seems like increasing fertility rate and providing comprehensive healthcare options are new focus areas.

A shift from achieving GDP via service sector towards GDP via high tech industries – One of the biggest differences in comparing the 13th FYP to the 14th FYP is the focus on GDP from core industries rather than the service sector.

Moving out of private education and healthcare providers and anything that keeps real estate prices high – Education, healthcare and real estate-are known as the three mountains, as these are the highest buckets of expenditures for an ordinary Chinese family.

Some of the themes that are coming out from Lillian Li are:

- China is on the way to reshuffle its economic blueprint.

- AI, Semiconductor and quantum computing are target growth areas

- Focus on Social welfare, hard-tech and low carbon emission

- Strong focus on increasing the population growth

6. Demographic Problem and Three Child Policy

Which brings us to why China is focussing so much on population growth now after all these decades of forcing the one child policy.

The one child policy was introduced in 1979 and was done to slow down population growth. But the impact of this was that the fertility rate dropped to such an extent that China increasingly became an ageing society. The number of newborns in China in 2020 was 12 million, down from 14.65 million in 2019, and China’s fertility rate of women of childbearing age was 1.3 (lower than Japan at 1.4. A fertility rate of 2.2 is needed just to balance) according to the latest census.

To solve this, China had announced a two child policy in 2016 and as that was not enough they announced a three child policy in May 2021. This time, the central government put forward supporting measures and a three-child birth policy as an overall package, considering factors such as marriage, childbirth, upbringing and education as a whole. Let’s refer back to Lillian Li again.

The big problem for encouraging people to have more children is the rising cost of raising a child, more specifically the cost of education and housing. And that’s where lie the reasons why China went after the education industry.

7. Private Tuitions And Predatory Practices

The private tutoring ecosystem can be described as highly competitive, overbearing and aggressive with lots of predatory practices. To really understand the amount of pressure these private tuition companies apply, just look at this ad that I picked from one of the blogs:

“Does your shopping cart contain your child’s future? If you do not enroll, we will be educating your child’s competitors”

After reading a few more of these you will suddenly find ads from Indian Ed-tech companies much more timid. The following Twitter threads from Daye Deng will help you understand the on ground situation more clearly. Daye is talking about his teenage cousin:

While China is going after their private education now, the same has been seen in South Korea 10 years back. Runaway tuition fees and mounting student stress prompted the Korean government to take stronger action. They even had police officers patrolling the streets at night to catch violators (late night private tutoring sessions).

Seeing all these we can make sense of what China has done for their education sector.

Education costs have been going up almost everywhere. College education cost has gone up 8 times faster than wage growth in the USA leading to $1.7 TN of student debt. While the US is a capitalist country, this may not lead to a backlash, but, I can clearly see the blueprint which could be followed in most emerging markets (including India).

8. 996 Culture Out Of Favor

996 refers to a work schedule of 9am to 9pm, 6 days a week. Another impact of recent shifts is that the 996 culture is increasingly out of favour. Chinese tech companies or Chinese companies in general have been infamous for gruelling overtime culture. It’s been labelled as exploitative and cruel.

Protocol reported that

“Both the [Chinese] government and the [tech] companies would face enormous public pressure if overworked tech workers start another high-profile protest or if poor labor conditions cause another public uproar in the press,” Suji Yan, a participant of the anti-996 campaign in 2019 and founder of Shanghai-based blockchain startup Mask Network, told Protocol. “Tech companies now fear public outcry as much as they fear new authoritarian rules.” (Suji is a pseudonym.)

The Chinese regulator has already kicked off a probe against monopolistic practices of delivery companies like Meituan. A new government video showing a local labour official working a 12-hour shift as a Meituan (a web based shopping platform) employee has been making the rounds on Chinese social media.

Some of the companies have already taken notice of this and cancelled mandatory overtime, announced compulsory punch out at 6pm and enforced weekends off.

9. What Lies Ahead

China actions on tech in general and education stocks in particular look very drastic and draconian and puts a lot of risk on the regulatory front. But it looks like there is some method to the whole thing. President Xi is very clearly taking the country more towards an authoritarian, socialist, party first approach. Policies are being geared towards hard tech vs consumer tech, high population growth, green energy and a more regulated approach.

The whole focus on increasing population has been taken to a different level with the Three Child Policy. Focus on workforce practices may mean higher wages and lower working hours. Companies are being regulated so that their employees get time to start a family. The Government is going after tuition and gaming companies so that kids get time and education becomes cheaper.

Antitrust regulations mean more competition between companies and also mean that companies like Tencent and Alibaba can open the ecosystem to each other. Most importantly there will be a lot more focus on cybersecurity and access to data to foriegn countries. We can continue to see a real drop in foreign listings of Chinese companies. This may also mean that the importance of HK as a source of international capital will continue to grow.

My biggest worry comes from what is next on their list, which is affordable housing. Property accounts for 70% of household assets in China. The property market is very large and a big driver of people’s wealth. While new home buyers will want cheaper houses, I am not sure how existing house holders will react if property prices start declining. More importantly banks have 29% of their balance sheets tied to real estate related loans.

To sum up, Lillian Li has really captured it well!

So, now that we understand a little more about what’s happening in China, where does that leave us? What are or will be the repercussions of these large shifts in China, on global markets and the global economy? More importantly, what could it mean for India in particular. One thing is clear that as China becomes tougher for foreign capital, some of it could find its way into Indian markets. There could be some other repercussions as well but perhaps that can be something for a later post!

thx for putting together such a considered compilation of views into the topic.

Policy to move from ConsumerTech to HardTech looks promising. They are making education cheap and housing affordable. Isn’t this something that is very good for the middle class. China will very soon the de-facto leader of the 21st century. Again showing the way to the rest of the world. How does Twitter, Facebook even help the middle class or growing economy? As rightly pointed out, these big-techs are thwaritng the elected democratic governments in many countries.